- Eicher Motors plans to increase Royal Enfield’s production capacity by more than a third

- The target is two million motorcycles per year

- A tax reduction for motorcycles up to 350 cc from 28 to 18 percent is driving demand

Royal Enfield, the motorcycle brand of Indian group Eicher Motors, is set for a significant expansion in capacity. Eicher Motors has informed investors that production at its Tamil Nadu site is to be expanded by more than a third. The stated goal is an annual production capacity of two million motorcycles. For a brand that has long been considered a niche provider outside India, this would be a leap into a completely new league.

Tax cut as growth driver for the 350cc segment

A key factor behind the growth is a tax cut by the Indian government. For motorcycles with an engine capacity of up to 350 cubic centimeters, the tax rate was reduced from 28 to 18 percent. Royal Enfield has a particularly strong presence in this segment. The effect was immediate: In the December quarter, Royal Enfield’s domestic sales rose by 24 percent, while the overall Indian two-wheeler market grew by 17 percent in the same period. Royal Enfield is thus growing significantly faster than the industry average.

Investment bank UBS sees the tax cut as a driver for increasing premiumization of the Indian motorcycle market and describes Royal Enfield as one of the main beneficiaries of this development.

Eicher Motors focuses on growing middle class market in India

Eicher Motors is not a familiar name in Germany or the US, but in India it is one of the most influential players in the automotive sector. The company is active in the commercial vehicle sector through a joint venture with Volvo and, with Royal Enfield, owns a brand that has established itself in recent years as one of the most important manufacturers in the mid-range motorcycle segment worldwide.

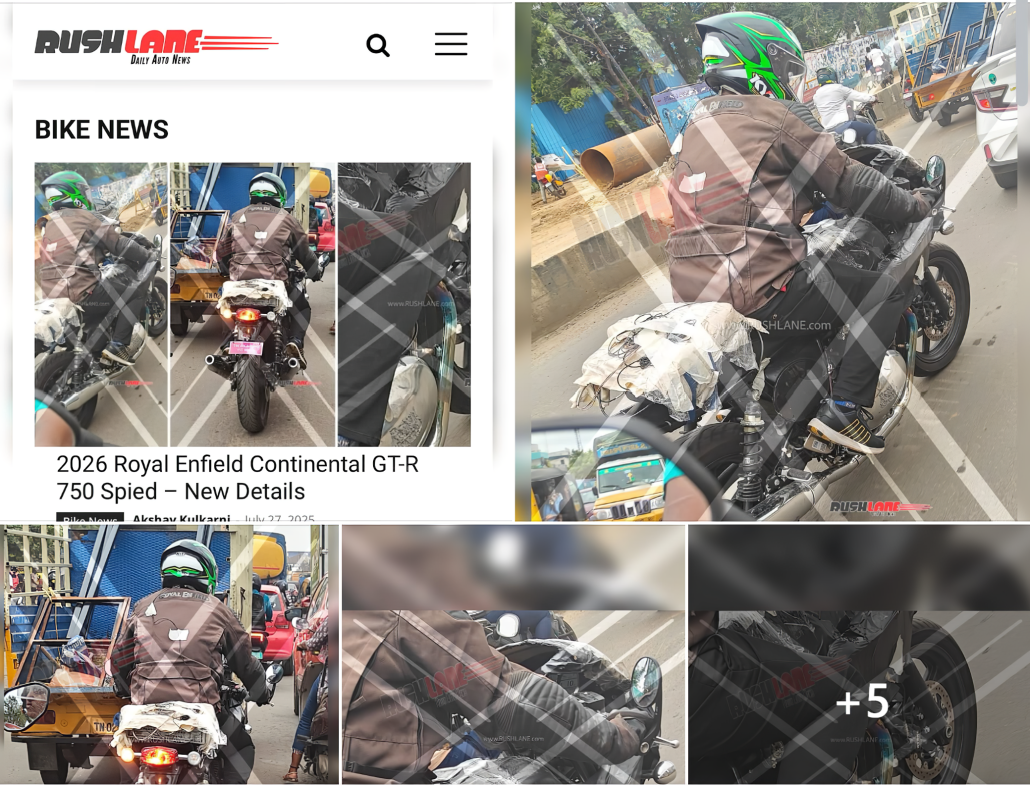

The product portfolio ranges from the high-volume 350 models to the 450 class with the liquid-cooled Himalayan 450 and the 650 series with the Interceptor 650 and the Continental GT 650. Eicher CEO B. Govindarajan told analysts that Royal Enfield aims to exceed industry-wide growth in the Indian two-wheeler market in the fiscal year ending March 2027. The industry expects high single-digit percentage growth for this period.

Eicher shares reach record high after announcement

The reaction on the stock market was significant. Eicher shares rose by just under seven percent to around 7,770 Indian rupees (approximately 72 euros / 86 US dollars), making them the strongest performers in both the Nifty 50 benchmark index and the Nifty Auto sector index. It was the share’s biggest daily gain since January 2025.

At least twelve analyst firms raised their price targets for Eicher Motors after the quarterly results. The median price target rose from 7,190 Indian rupees (approximately 67 euros / 79 US dollars) to 7,500 Indian rupees (approximately 70 euros / 83 US dollars).

Competition in the mid-range segment: The toughest phase is said to be over

In recent years, Royal Enfield had faced increasing competition in the mid-range segment, including from Triumph and locally produced models from Harley-Davidson. Investment bank Jefferies now considers this phase of intense competition and margin concerns to be over. The recovery in larger models, whose tax rate has been raised, is also encouraging, as Citigroup noted in an analysis. Both sales figures and margins showed positive trends.

Production volume as a lever for research and global expansion

From a product perspective, a capacity of two million units opens up strategic opportunities. Those who manufacture at these volumes can invest more in research and development, new platforms, and the expansion of international distribution networks. If the two million mark is actually reached, the pace of new model launches is likely to accelerate further.

For riders worldwide, this could mean a wider choice of motorcycles, denser dealer networks, and more competitive prices in the medium term. Economies of scale can translate into better margins or lower prices in export markets, sometimes even both at the same time.

Royal Enfield positions itself against the industry trend

The broader industry context is also interesting. Numerous established motorcycle brands in mature markets are struggling with an aging customer base. Entry-level prices are rising, while younger potential buyers are increasingly mindful of their spending. Royal Enfield is taking a different approach, consistently focusing on accessible motorcycles with moderate power that can comfortably keep up on the highway, offer usable torque, and retain a mechanical character. The target group for such machines is clearly growing, and a production capacity of two million units per year is a clear signal that this target group is by no means small.

Capital investment signals confidence in own production

The expansion in Tamil Nadu is also a commitment to domestic production. Instead of proceeding cautiously, Eicher Motors is apparently investing considerable capital to ramp up capacity. This suggests that management expects sustained demand not only in India but also in export markets such as North America, Europe, and Southeast Asia.

In recent years, the global motorcycle industry has experienced supply chain problems, regulatory changes, and a shift in consumer behavior. Some manufacturers are scaling back their activities, while others are increasingly focusing on electric drives. Royal Enfield is pursuing a comparatively straightforward course: build more motorcycles, sell more motorcycles, and focus on its core business.

If the target of two million units is achieved, Royal Enfield would not only be the leading supplier in the mid-range motorcycle segment in India, but also one of the highest-volume manufacturers in the global motorcycle industry above the entry-level class.